Grow Your Business to Greatness

Find all the money you qualify for, then review your lending options alongside expert guidance

Start-Up Capital

Up to $300K

Why would I need start-up capital for a new business?

Starting up a business or venture often requires funding, resources, and guidance to get off the ground. Here are some reasons why someone or an entity would need a start-up:

Reasons for Needing a Start-Up:

Entrepreneurial Vision: Individuals with innovative ideas need a platform to bring their products or services to market.

Financial Independence: People often seek to establish a start-up to create their own income streams and reduce reliance on traditional employment.

Market Opportunity: Entrepreneurs may identify a gap in the market or a demand for a specific product or service and create a start-up to fulfill that need.

Technological Advancements: New technology often leads to opportunities for start-ups to develop solutions that didn't exist before.

Social Impact: Some individuals or entities want to address societal challenges like climate change, poverty, or education by creating start-ups focused on these issues.

Growth and Expansion: Established businesses may need a start-up to enter new markets or launch new product lines without affecting their core operations.

Common Use Cases for Start-Ups:

Technology Innovation: Developing new software, apps, or digital solutions in fields like AI, blockchain, or e-commerce.

Health and Wellness: Launching companies focused on health tech, medical devices, or personalized health services.

E-commerce and Retail: Setting up online stores or marketplaces to sell products directly to consumers, offering convenience and niche options.

SaaS (Software as a Service): Providing cloud-based software solutions to solve specific business problems, such as accounting, customer service, or project management tools.

Fintech: Developing financial technology solutions for payment processing, personal finance, loans, or cryptocurrency trading.

Sustainable Solutions: Starting businesses that focus on eco-friendly products, renewable energy, or waste management systems.

Education and Training: Building platforms for online learning, professional development, or skill-building.

Consulting Services: Offering expertise in specialized fields such as marketing, legal advice, financial consulting, or business development.

Each start-up serves a unique purpose, but they all aim to solve problems, fulfill a demand, or introduce innovation into various industries.

Basic Qualifications for Start Up Capital

Up to $300,000

680+ Personal Credit Scores in all 3 bureaus

2-years personal tax returns showing $50,000 or more of taxable income

Term Loan Program

No minimum length of time in business

Fixed monthly payment

No Upfront fees

Full liquidity Immediately

Funding in 7 to 15 business days

680+ Personal Credit Scores in all 3 bureaus

2-years personal tax returns showing $50,000 or more of taxable income

Secure Funding For Anything You Need To Start or Grow Your Dream Business.

Inventory

Employees

Startups

Payroll

Consulting

Franchises

vehicles

Marketing

Real Estate

Ecommerce

Emergencies

Restaurants

expansions

Any kind of business or project

Asset Based Financing

Funding Amount

Up To $100M

Repayment

Up to 25 years

Time to Fund

1 to 7 days

What Is Asset-Based Lending

Asset-based lending is a type of business financing in which the lender secures the agreement with an asset or collateral. Asset-based lending can give the borrower either a loan or line of credit.

Collateral for asset-based lending doesn’t need to be real estate. Other more liquid assets, like receivables, inventory, purchase orders, and potentially equipment, can also act as collateral. You can leverage one or more of these assets to secure a loan or an ongoing credit facility/line of credit for your business.

Unlike other financing options, your business can qualify for asset-based financing with a low credit score or no history. Rather than meeting traditional requirements, you can qualify based on your receivables, inventory, or other assets.

Asset-based lines of credit and loans help you capitalize on the value of your liquid assets immediately. Instead of waiting for payments, you can get working capital to cover expenses like growth, expansion, additional inventory purchases, and more.

How Does Asset-Based Lending Work?

Asset-based lending is similar to other business financing options—you receive cash to grow your business and repay it over time. The key difference is that you use an asset (explained below) as collateral. While you can offer real estate, there are often simpler, lower-risk options available.

Many businesses, both new and established, face cash flow challenges due to fast growth or slow-paying customers. Asset-based lending provides quick access to cash by leveraging assets like receivables, inventory, and more. It's commonly used for working capital, seasonal slowdowns, or delayed payments.

By offering collateral, you reduce the lender's risk, which may result in a lower interest rate. Rates can vary depending on several factors, though. Lenders typically prefer liquid assets, like receivables, over less liquid ones, like equipment, but using equipment as collateral is still a viable option.

Types of Assets You Can Use as Collateral

Asset-based lending uses collateral, but it doesn’t have to be physical assets like land or real estate. There are various types of collateral you can use to secure loans or lines of credit and increase your borrowing capacity.

That said, lenders typically value some assets more than others. They usually prefer liquid assets because they offer more security with less risk. However, illiquid assets like land and real estate can still be used, especially if combined with other assets to enhance your security.

Accounts Receivable or Invoices

Utilize unpaid invoices from late-paying customers to unlock new cash and invest in the future of your business.

Inventory

Put up unsold inventory as collateral. While your inventory may be valued at wholesale, rather than market rates, you can still gain significant leverage.

Purchase Orders

Instead of turning down future sales due to working capital shortages, sell future sales to receive cash for materials and capitalize on your opportunities.

Equipment

Secure your financing with a hard asset, like collateral. The easier a lender can resell the equipment on the secondary market, the better your equipment will function as collateral.

Real Estate

Real estate can add extra security for hard money lenders, but is best used in asset-based lending when coupled with more liquid assets. It’s a great form of secondary collateral that you can use to qualify for additional financing when receivables don’t cover exactly what you need.

Unsure of which collateral you can use to qualify for asset-based lending? After applying, speak with your lender about the assets you have available and learn which would make the most sense based on your needs.

The Advantages of Asset-Based Financing

In today’s lending landscape, many financing options don’t require collateral. However, offering assets as collateral can be a smart move if you need cash.

Here’s why your growing business should consider this often overlooked option:

Without putting up real estate, you can get cash to grow your business

Asset-based loans and revolving lines of credit are fast and simple to obtain

You can qualify as a young or new business owner, as long as you have the required assets

Assets lower the lender’s risk, which generally means you can qualify for lower interest rates

Utilizing an asset unlocks your ability to borrow more and qualify for higher funding amounts

As long as you can prove your ownership of the asset, you can receive fast approvals and immediately boost cash flow

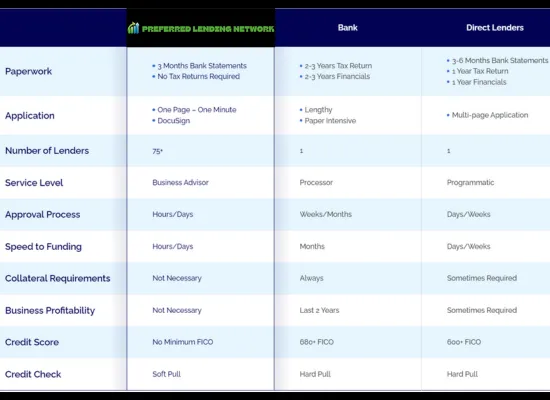

Banks Vs. Marketplaces

Where should you apply for an asset-based loan? There are a few things to consider to find the best fit for your business.

Banks typically offer lower interest rates, but the application process can be long, with higher credit score and revenue requirements. Even if you qualify, you might only have one option, which may not be ideal. Choosing the wrong loan could leave your business stuck repaying something that doesn’t truly help.

Marketplaces, on the other hand, make the process easier and often give you access to multiple lenders. Many specialize in specific industries and types of collateral, ensuring you can compare and choose the best option for your needs.

Qualifying for Asset-Based Lending

Marketplaces have a simpler and easier qualification process that ensures you can review more options faster. Here are our Lender's qualifications.

$500K in Current Receivables

Assets or Collateral

The lender will approve your company to borrow based on the collateral’s posted value on the balance sheet. The more valuable your asset or assets, the more the lender will feel comfortable approving your business for.

How to Use Asset-Based Loans

When it comes to fast cash for urgent working capital needs, asset-based lending is a simple, fast and easy option. Generally, there are no restrictions on how you can spend these funds.

Fuel Business Growth:

Take the next steps in growing and expanding your business by opening a new location, expanding offerings, and more

Fund Inventory Purchases:

Obtain inventory in bulk quantities to lower costs and drive profits, especially during peak periods

Fill New Orders:

Invest in growth by purchasing the materials you need to fill incoming orders, despite high upfront costs

Cover Expenses:

Stay on top of rising operating costs like rent, insurance and more with an asset-based loan or credit line

Keep Extra Cash on Hand:

Never miss a new, revenue-generating opportunity again with extra cash in your back pocket

Endure Slow Seasons:

Cover expenses like payroll, operating costs, and marketing during slow seasons when revenue is down

Reduced and Avoid Your Income Tax Burden:

Visit our live Webinar and reserve a slot to learn more.

Click the glowing button to continue.

You can put your additional working capital toward any expenses that will help your business grow!

Examples: How Industries Use Asset-Based Lending as a Financing Tool

Asset-based lending offers a viable way to grow your business fast, instead of waiting around for working capital to catch up with your needs.

From a very early point, small, medium, and large businesses can all utilize asset-based lending to grow. Here are a few examples of how companies in certain industries have already grown with ABL:

eCommerce:

As demand increases, eCommerce companies can use asset-based financing to buy more inventory, increase marketing, and land new customers.

Marketing & Technology:

Put up unsold inventory as collateral. While your inventory may be valued at wholesale, rather than market rates, you can still gain significant leverage.

Textile & Shoe:

Fast-growing textile and shoe companies frequently use ABL to purchase supplies and inventory ahead of bulk transactions.

Wholesale:

ABL ensures wholesalers have the cash they need for high-ticket transactions that yield substantial returns, especially while getting things off the ground.

Gas & Oil:

While gas and oil sales have sky-high profit margins on the distribution side, purchasing supply can be a cost challenge—which is where asset-based loans often help.

Medical Supply:

Distributors, especially those selling PPE, tend to utilize asset-based lending in order to place bulk orders for inventory at the lowest, most cost-effective rate.

Business Line Of Credit

Line Amount

$100,000 to $10 Million

Revolving

Draw funds on an as-needed basis

Time to Fund

24 to 72 hours

Qualifications for a Business Line of Credit

Time In Business

2+ months in business

Gross Revenue

$200,000+ in Annual Revenue

Credit Score

551+ personal or business credit

What Is A Business Line of Credit

A small business line of credit gives you flexible access to cash on an as-needed basis. This type of financing allows you to draw cash from your total credit limit for any business purpose – and only pay interest on what you use.

With a revolving line of credit, more cash will become available as you pay down your balance. Unlike selling equity, the funds from a business line of credit allow you to maintain business ownership, profits, and full control.

You can also use it to bridge cash flow gaps during seasonal slumps or as a rainy day fund. There are no restrictions on how you can use it – you can use a business line of credit to cover any costs or opportunities you face.

Essential Requirements for Obtaining a Business Line of Credit

Wondering how to apply for a business line of credit? Different lenders have varying requirements, so your chances of qualifying depend on where you apply. A big advantage of using a marketplace is that you can explore multiple options with just one application.

Banks and credit unions often have stricter qualifications, making it harder to get approved if your business doesn’t have a perfect financial record. However, even if a bank denies your application, online lenders may approve you based on your annual sales.

Online lenders are typically faster, with streamlined processes that can get you funding in as little as 24 hours. Marketplaces like National are more flexible, focusing on your business potential rather than just your credit history, making it easier and quicker to qualify for a business line of credit.

As for documentation, here’s what you’ll need:

Driver’s license

Business bank statements (going back least 2 months or 1 year, pending on which lending partner we refer you to)

Business credit score (our lending partners will obtain this)

Financial statements (this is case by case, but if you do not have, then we can help. Visit our Financial Perpetration Service Page by the glowing button below)

Time in business

Proof of ownership (K1, schedule C, EIN, certificate of corporation, etc.

Collateral (if secured)

Cash flow statement (this is case by case, but if you do not have, then we can help. Visit our Financial Perpetration Service Page by the glowing button below)

Business plan (case by case)

Some lenders require alternate documentation to determine your eligibility, but the above list is the most commonly requested.

How Does a Business Line of Credit Work?

Business lines of credit function like credit cards but with a different structure that’s better suited for small business owners. They’re also better for tax purposes – you can write off interest on a credit line but not for a personal credit card.

After qualifying for a business line of credit, you’ll receive a total credit limit. You can draw as much or as little as you need from that total limit in any number of installments, and you’re under no obligation to use the full amount.

This is done online, where you log into an account and transfer funds from your credit line to your business bank account.

You can continue to access additional cash as you pay it down. Instead of paying interest on the full credit limit, you’ll only pay interest on what you take. Depending on your lender, you may have a non-utilization fee and may have to pay for the line if you don’t use it. Before signing an agreement, be sure to ask for clear information about any fees. Avoid any agreements without clear, transparent information.

Remember – The “best” business line of credit is one that fits your business and where it’s headed. Make sure you work with a reputable, transparent lender to ensure that your financing fits your goals and won’t place any restrictions on how you grow.

How Does a Revolving Line of Credit Work?

Unlike small business loans, revolving lines of credit work by allowing you to continue accessing additional funds as you pay your balance down and require more cash. In other words, it is a type of loan in which the user can borrow up to their credit again once the debt is repaid.

Some business lines of credit are revolving, while others aren’t. When you discuss the terms of your agreement, be sure to ask questions and confirm whether or not your line of credit is revolving. Revolving lines of credit are the fastest and easiest way to access additional cash as your business grows. Once you pay down part of the balance, you can draw more cash without reapplying. It’s simple, fast, and easy, and your working capital won’t be limited to your checking account.

For example, say you qualify for a $100,000 line of credit. You borrow the full $100,000 and use the cash to grow your business. You then pay down $50,000 using the revenue you generate, putting both your balance and credit limit at $50,000. With $50,000 paid down, you now have the option to borrow an additional $50,000. There’s no set end date, either. As long as you keep your credit line active or continue drawing and paying it down, you can utilize a LOC for months or even years. If you’re not actively using it, though, your small business line of credit may expire.

A top business line of credit option is one that has exactly what you need. If you aren’t satisfied with the first offer, don’t worry – there’s always a better deal out there.

Small Business Credit Line Benefits

A business line of credit is a valuable tool to have at your disposal. Its flexibility lets you access funds whenever needed, helping you stay ahead of challenges—an invaluable asset for any entrepreneur. Here are just a few benefits of using a business line of credit:

Fast access to cash

Only pay interest on what you draw; although, one our lending partner requires principle payments too.

Might not need to offer collateral

Manage your working capital, short-term projects, and other expenses

Strengthen your business credit

A business line of credit can significantly impact the growth of new businesses. It offers flexible access to capital, allowing you to expand your business without straining your cash flow.

Unlike term loans or SBA loans, which provide a fixed amount that you repay over time, a line of credit lets you draw only what you need from your available credit. This avoids the need for additional loans if your needs change, making it easier to manage your finances and support your growth plans.

How Can You Use Business Line of Credit Funds?

Lines of credit are intended to be flexible financing options custom-tailored to your needs. You can use them to cover expenses that are weighing your business down or pursue exciting new growth opportunities.

There are no restrictions on how you must spend this money – you can put it toward any expenses. Some of the most common ways that businesses utilize this business financing option include:

Grow Your Business – Ramp up your business and cover the expenses needed to expand hiring, payroll, take on new jobs, and more.

Operating Costs – Always have cash on hand for rent, utilities, and other costs required to keep your business going on a day-to-day basis.

Marketing Campaigns – Drum up new business and take on more customers with additional marketing campaigns in the mix.

Seasonal Slow Periods – Get the capital you need to keep your business moving during seasonal slow periods.

Inventory or Supplies – Purchase additional inventory or supplies to capitalize on busy periods and new opportunities.

Payroll – Keep a reservoir of funding to cover the costs of payroll, especially with slow-paying clients.

Avoid Income Tax Burdens - Learn How By Reserving a Slot in a Live Free Webinar

Access to a line of credit is like having cash on demand. The second you need cash, you can draw from your line of credit and get things moving.

You may also have to provide a personal guarantee, which is standard with most types of business financing, and is similar to a personal guarantee you already have with your credit cards.

Applying for a Business Line of Credit

Applying for a line of credit is easy, and simply learning your options won’t affect your credit score. Here’s how it works:

Apply

Fill out our simple 60-second application to begin the process. Then, complete your online application by connecting your bank statements through our bank-grade portal in under 3 minutes.

Review

Consider multiple loan options available within our marketplace. Hear your options explained by a knowledgeable Business Financing Advisor, and ask any questions you have.

Get Funded

Select the best option available and get funded in as little as a few hours. Start using your cash to grow your business right away, without restrictions on how you can use the funds.

We educate you on the best options available within our platform to ensure you get the best line of credit available.

Business Term Loans

Funding Amount

$100,000 to $10 Million

Loan Term

You can opt for longer or shorter terms, depending on your business needs & capability

Time to Fund

24 to 72 hours

How Do You Qualify for Term Loans?

1+ Year In Business

$500,000+ in Annual Revenue

What Is a Term Loan?

A term loan allows borrowers to access a set amount of capital they must repay over time. The total amount, plus interest, is repaid throughout the term through monthly, weekly, or daily payments, depending on the length of your financing.

Businesses leverage term loans for challenges and opportunities in their business. Whether you’re looking to bridge a payment gap, hire new staff for an upcoming project, or invest in a new marketing initiative, this type of financing can offer the funds you need to accomplish your goals.

Unlike private equity, debt financing provides capital without an exchange of ownership. You maintain full ownership of your business after securing a term financing; The only risk is the financial ramifications of late payments/total defaults.

Bronze National SEO Package

Month 1

Domain Authority Booster

Boost Your Rankings: Higher Domain Authority (DA) means better search engine rankings.

Outshine Competitors: Use DA to gain an edge and dominate your niche.

Score Quality Backlinks: High DA attracts valuable backlinks, boosting your site’s authority.

Starter Backlink SEO Package

100 Citations & Press Release: Establish your business identity with 100 citations and a branded press release for visibility.

50 Branded Websites: Build 50 high-authority sites linking back to reinforce your online presence and NAP (if any) details.

✅ 350+ Branded Press Releases

✅ 10 Guest Posts on High DA Websites with Traffic

✅ 10 Niche Edits on High DA Websites with Traffic

✅ 40 Blogs per month

Types of Term Loans

Bronze National SEO Package

Month 1

Domain Authority Booster

Boost Your Rankings: Higher Domain Authority (DA) means better search engine rankings.

Outshine Competitors: Use DA to gain an edge and dominate your niche.

Score Quality Backlinks: High DA attracts valuable backlinks, boosting your site’s authority.

Starter Backlink SEO Package

100 Citations & Press Release: Establish your business identity with 100 citations and a branded press release for visibility.

50 Branded Websites: Build 50 high-authority sites linking back to reinforce your online presence and NAP (if any) details.

✅ 350+ Branded Press Releases

✅ 10 Guest Posts on High DA Websites with Traffic

✅ 10 Niche Edits on High DA Websites with Traffic

✅ 40 Blogs per month

How Do Term Loans Work?

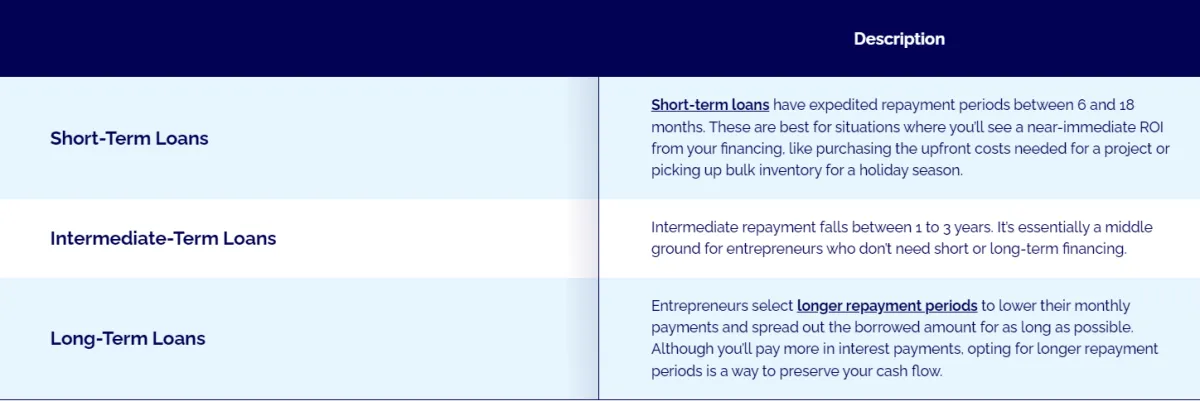

Term loans, as the name implies, provide a set amount of money to be repaid over a specific period.

You can choose a short-term loan for immediate needs that will generate a return within the repayment period, or a long-term loan for larger projects or investments that won't pay off right away.

Some lenders require collateral to secure the loan. Secured term loans often have easier eligibility requirements and lower interest rates, but not all businesses can offer collateral. Unsecured loans are an alternative, though they may come with stricter eligibility criteria and higher interest rates.

Remember, using your funding is easy, but repaying it can be challenging. Prioritize timely, consistent payments to avoid defaulting on your loan. While a couple of late payments may not be disastrous, missing payments can put your financing at serious risk.

Bronze National SEO Package

Month 1

Domain Authority Booster

Boost Your Rankings: Higher Domain Authority (DA) means better search engine rankings.

Outshine Competitors: Use DA to gain an edge and dominate your niche.

Score Quality Backlinks: High DA attracts valuable backlinks, boosting your site’s authority.

Starter Backlink SEO Package

100 Citations & Press Release: Establish your business identity with 100 citations and a branded press release for visibility.

50 Branded Websites: Build 50 high-authority sites linking back to reinforce your online presence and NAP (if any) details.

✅ 350+ Branded Press Releases

✅ 10 Guest Posts on High DA Websites with Traffic

✅ 10 Niche Edits on High DA Websites with Traffic

✅ 40 Blogs per month

How Can I Use My Term Loan?

Entrepreneurs secure term loans to solve challenges or take advantage of opportunities in their businesses. Let’s explore a few of the most common.

Cover Expenses

The cost of your inventory, payroll, rent, and other operational expenses can limit your liquidity and make growth challenging. Funding offers the opportunity to cover these expenses and focus on other areas of your business.

Bridge Payment Gaps

Late customer payments can congest your cash flow. With a term loan, you’re provided with a lump sum of cash to cover these costs until invoices are paid.

Bronze National SEO Package

Month 1

Domain Authority Booster

Boost Your Rankings: Higher Domain Authority (DA) means better search engine rankings.

Outshine Competitors: Use DA to gain an edge and dominate your niche.

Score Quality Backlinks: High DA attracts valuable backlinks, boosting your site’s authority.

Starter Backlink SEO Package

100 Citations & Press Release: Establish your business identity with 100 citations and a branded press release for visibility.

50 Branded Websites: Build 50 high-authority sites linking back to reinforce your online presence and NAP (if any) details.

✅ 350+ Branded Press Releases

✅ 10 Guest Posts on High DA Websites with Traffic

✅ 10 Niche Edits on High DA Websites with Traffic

✅ 40 Blogs per month

Increase Purchasing Power

Funding complements your liquidity and gives you the ability to make larger purchases. Instead of figuring out a way to afford a sizable purchase, you can manage the payment over time and preserve your cash flow.

Invest in Growth

Growth isn’t easy, and it’s definitely not cheap. Financing allows you to invest in your business and, more importantly, take advantage of opportunities that come your way.

How Do You Qualify for Term Loans?

Every lender has different qualifications. Some specialize in startups, while others only work with the most established businesses. In either case, you’ll have to meet minimum credit score, annual revenue, and time in business requirements to reach an approval, which will differ depending on the lender you’re working with.

There are two main types of lenders.

Bank and Credit Unions

Often the first stop for entrepreneurs, banks and credit unions are commonly referred to as the “traditional lenders.”

Most banks and credit unions need to see 700+ credit scores, $500,000+ in annual revenue, and 2+ years of business experience to approve your business for financing. They offer term financing with low interest rates and favorable terms, but receiving an approval is challenging due to their restrictive eligibility criteria.

In addition, the time it can take can be 30 to 90+ days to get the funds.

Silver National SEO Package

Month 1

Domain Authority Booster

Boost Your Rankings: Higher Domain Authority (DA) means better search engine rankings.

Outshine Competitors: Use DA to gain an edge and dominate your niche.

Score Quality Backlinks: High DA attracts valuable backlinks, boosting your site’s authority.

Starter Backlink SEO Package

100 Citations & Press Release: Establish your business identity with 100 citations and a branded press release for visibility.

50 Branded Websites: Build 50 high-authority sites linking back to reinforce your online presence and NAP (if any) details.

✅ 350+ Branded Press Releases

✅ 20 Guest Posts on High DA Websites with Traffic

✅ 20 Niche Edits on High DA Websites with Traffic

✅ 80 Blogs per month

How Do You Qualify for Term Loans?

Private Lenders

Private lenders, otherwise known as non-bank lenders, exist outside of banks and credit unions.

Some don’t enforce credit score minimums, but a majority require 580+ credit scores, $200,000 in annual revenue, and at least one year in business (in some case less than 2-months). They offer a wide range of financing solutions with less restrictive eligibility requirements and faster funding times, but they often come with higher interest rates on average.

At Preferred Lending Network, we have options for all credit profiles through our preferred lending partner.

Pros and Cons of Term Loans

Business term loans come with numerous benefits, but they aren’t a blanket solution for every entrepreneur.

Pros

Lump sum payment to invest in your business

No exchange of equity

If a lender reports to a business credit bureau, repayment can strengthen your business credit score

Consistent, timely repayments can build creditworthiness and credibility with your lender

Stagnant payment schedule

Silver National SEO Package

Month 1

Domain Authority Booster

Boost Your Rankings: Higher Domain Authority (DA) means better search engine rankings.

Outshine Competitors: Use DA to gain an edge and dominate your niche.

Score Quality Backlinks: High DA attracts valuable backlinks, boosting your site’s authority.

Starter Backlink SEO Package

100 Citations & Press Release: Establish your business identity with 100 citations and a branded press release for visibility.

50 Branded Websites: Build 50 high-authority sites linking back to reinforce your online presence and NAP (if any) details.

✅ 350+ Branded Press Releases

✅ 20 Guest Posts on High DA Websites with Traffic

✅ 20 Niche Edits on High DA Websites with Traffic

✅ 80 Blogs per month

Pros and Cons of Term Loans

Cons

Not as flexible as business lines of credit

If you need additional funds, you’ll have to take out another loan

Interest rates can be higher than other forms of financing

May need to offer collateral

Term loans are best used for challenges, opportunities, and projects where you know exactly how much you’ll need. They don’t offer the flexible access to capital that a business line of credit can, nor do they offer the specialized benefits of equipment financing. But if you’re looking for a lump sum of cash to manage throughout your repayment period, they’re an excellent resource to leverage as you invest in your business.

How to Apply for a Term Loan for Business

Entrepreneurs can secure term loans from banks, credit unions, private lenders, and FinTech marketplaces. Each organization will offer different rates, terms, and funding amounts, so it’s recommended to shop around and receive multiple offers to ensure you’re getting the best deal.

Get In the Right Headspace

Before you start applying to lenders, though, there are a few important questions you should ask yourself:

How much do I need?

When do I need it?

What am I using the money for specifically?

Do I have a plan on how I’ll use the funds

How long will I need to repay the borrowed amount?

How much can I afford to pay for my financing?

These will get you into the right headspace and, more importantly, ensure you’re entering the situation with a plan. Once you’ve done this, it’s time to start applying to lenders.

Silver National SEO Package

Month 1

Domain Authority Booster

Boost Your Rankings: Higher Domain Authority (DA) means better search engine rankings.

Outshine Competitors: Use DA to gain an edge and dominate your niche.

Score Quality Backlinks: High DA attracts valuable backlinks, boosting your site’s authority.

Starter Backlink SEO Package

100 Citations & Press Release: Establish your business identity with 100 citations and a branded press release for visibility.

50 Branded Websites: Build 50 high-authority sites linking back to reinforce your online presence and NAP (if any) details.

✅ 350+ Branded Press Releases

✅ 20 Guest Posts on High DA Websites with Traffic

✅ 20 Niche Edits on High DA Websites with Traffic

✅ 80 Blogs per month

Come Prepared

The application process for business term loans differs from lender to lender, but you can expect to provide the following information:

At least one full year of business bank statements

Two – most recent – business tax returns

Balance sheets

Cash flow statement

Profit and loss statement

Business debt schedule, if applicable

Details of accounts receivable and accounts payable

Description of and proof of ownership for collateral

Proof of business insurance

Licenses, permits, articles of incorporation, and other legal documents

Business certificate

Detailed personal financial information

Complete business plan, including a detailed description of your business, products or services, structure, management, and marketing plan, as well as financial projections

What to Expect

Each of these documents will help the lender understand your business as a whole. Once submitted, they’ll begin their review process and determine what terms you qualify for. This time period is commonly referred to as the “underwriting process.”

The lender will return with an approval or denial of your application. If you’re approved, you’ll receive a contract with a funding amount, interest rate, and repayment schedule your business qualifies for. There’s some room for negotiation, so feel free to push back and ask why your contract is a certain way.

After you’ve applied with multiple lenders, found the best one, locked in your contract, and received your funds, you can start leveraging them for your opportunity or challenge. Don’t get carried away with spending; Stick to your plan and invest strategically, taking note of how you’ll repay the borrowed funds with each investment or purchase.

Silver National SEO Package

Month 1

Domain Authority Booster

Boost Your Rankings: Higher Domain Authority (DA) means better search engine rankings.

Outshine Competitors: Use DA to gain an edge and dominate your niche.

Score Quality Backlinks: High DA attracts valuable backlinks, boosting your site’s authority.

Starter Backlink SEO Package

100 Citations & Press Release: Establish your business identity with 100 citations and a branded press release for visibility.

50 Branded Websites: Build 50 high-authority sites linking back to reinforce your online presence and NAP (if any) details.

✅ 350+ Branded Press Releases

✅ 20 Guest Posts on High DA Websites with Traffic

✅ 20 Niche Edits on High DA Websites with Traffic

✅ 80 Blogs per month

Contractor Business Loans

Funding Amount

$100,000 to $10 Million

Repayment Optio

Unique to the business's operational needs

Time to Fund

24 to 72 hours

How Do You Qualify for

Contractor Business Loans?

1+ Year In Business

$500,000+ in Annual Revenue

What Are Contractor Business Loans?

Fundamentally, a contractor business loan is a type of specialized financing designed specifically for the construction sector. Unlike traditional loans and financing, loans for contractors often come with unique terms and conditions that align with the cyclical, seasonal, and unpredictable nature of the industry.

Funds arrive either in a lump sum or credit line format, where the borrower draws as needed from their total credit limit. Contractors can use their financing for:

Equipment and tools

Materials and supplies

Cash flow management

Hiring

Marketing

Supporting a higher workload

Unexpected growth opportunities/challenges

Whether you’re looking to handle immediate expenses or finance long-term projects, specialized contractor financing offers the capital and structure needed to meet contractors’ unique needs.

E-Commerce SEO Package Tier 1

Month 1

Domain Authority Booster

Boost Your Rankings: Higher Domain Authority (DA) means better search engine rankings.

Outshine Competitors: Use DA to gain an edge and dominate your niche.

Score Quality Backlinks: High DA attracts valuable backlinks, boosting your site’s authority.

Starter Backlink SEO Package

100 Citations & Press Release: Establish your business identity with 100 citations and a branded press release for visibility.

50 Branded Websites: Build 50 high-authority sites linking back to reinforce your online presence and NAP (if any) details.

✅ 5 Niche Edits on High DA Websites with Traffic

✅ 5 Guest Posts on High DA Websites with Traffic

✅ 350+ Branded Press Releases

✅ 20 Blogs per month

Types of Contractor Business Loans

There is significant variation in the contractor loan market, with each route having its own set of advantages and disadvantages. Here are the main types of loans that contractors can utilize:

Short-Term Loans: Ideal for contractors in need of a quick cash boost, short-term loans offer a convenient solution for immediate financial requirements. Despite the higher interest rates, these loans are appealing to many due to their ease of access and minimal paperwork requirements.

Long-Term Loans: For contractors looking to make significant expansions or large-scale purchases, long-term loans provide the opportunity to secure larger amounts of funding at more favorable interest rates. These loans offer a longer repayment period, but they typically involve collateral and a more thorough approval process.

Lines of Credit: Business lines of credit offer the utmost flexibility, allowing contractors to draw funds as needed and pay interest only on the amount used. This option is ideal for managing fluctuating cash flow needs, though it may come with fees and requires a solid credit history for approval.

Revenue-Based Financing: Catering to businesses with steady revenue streams, this option allows contractors to access capital based on their monthly or annual revenue. Repayment is usually calculated as a percentage of the business’s revenue, which allows for flexibility as it aligns with the company’s income levels. This can be especially beneficial for contractors who have fluctuating project timelines and payment schedules.

Equipment Financing: This type of loan, specifically intended for buying equipment, offers lower interest rates and directly increases the business’s operational capacity by using the purchased equipment as collateral.

Invoice Financing: Invoice financing allows contractors facing payment delays to receive an advance on their unpaid invoices, which improves their cash flow without having to wait for client payment. Although fees will have a negative impact on total revenue, this alternative could be crucial for effectively handling short-term liquidity.

Preferred Lending Network’s longstanding lender relationships work in contractors’ favor. Our Business Finance Advisors negotiate on behalf of your business to achieve specialized structures and contract exceptions that allow you to Grow Your Business to Greatness with as little friction as possible.

E-Commerce SEO Package Tier 1

Month 1

Domain Authority Booster

Boost Your Rankings: Higher Domain Authority (DA) means better search engine rankings.

Outshine Competitors: Use DA to gain an edge and dominate your niche.

Score Quality Backlinks: High DA attracts valuable backlinks, boosting your site’s authority.

Starter Backlink SEO Package

100 Citations & Press Release: Establish your business identity with 100 citations and a branded press release for visibility.

50 Branded Websites: Build 50 high-authority sites linking back to reinforce your online presence and NAP (if any) details.

✅ 5 Niche Edits on High DA Websites with Traffic

✅ 5 Guest Posts on High DA Websites with Traffic

✅ 350+ Branded Press Releases

✅ 20 Blogs per month

How Do Contractor Business Loans Work?

The process begins with the application, where contractors must provide details about their business, including financial statements, credit score, business plan, and the purpose of the loan. Lenders use this information to assess the borrower’s creditworthiness, the business’s financial stability, and the feasibility of the business plan.

Some documents lenders may ask for include:

Financial statements (Balance sheets, income statements, cash flow statements, etc.)

We Can Assist You With This

Click the Glowing Button

Credit score and history reports

Business plan

Tax returns

Bank statements

Collateral documentation

Business legal documents (Licenses, permits, articles of incorporation, commercial leases, franchise agreements, etc.)

Debt schedule

Proof of ownership

Insurance information

Projections and forecasts

E-Commerce SEO Package Tier 2

Month 1

Domain Authority Booster

Boost Your Rankings: Higher Domain Authority (DA) means better search engine rankings.

Outshine Competitors: Use DA to gain an edge and dominate your niche.

Score Quality Backlinks: High DA attracts valuable backlinks, boosting your site’s authority.

Starter Backlink SEO Package

100 Citations & Press Release: Establish your business identity with 100 citations and a branded press release for visibility.

50 Branded Websites: Build 50 high-authority sites linking back to reinforce your online presence and NAP (if any) details.

✅ 10 Niche Edits on High DA Websites with Traffic

✅ 10 Guest Posts on High DA Websites with Traffic

✅ 350+ Branded Press Releases

✅ 40 Blogs per month

Once approved, businesses enter the contract negotiation phase, where they’ll work with their lender to refine the offered terms. Keep in mind that over-qualified businesses hold stronger negotiating power than those who just barely meet minimum requirements.

Both you and the lender will need to agree on a contract for the transaction to move forward, but don’t feel pressured to accept an offer that doesn’t work for your business. Once you’ve come to an agreement with your lender, you’ll finalize the contract, receive your funds, and begin the repayment process.

What to Know About Repayment Terms

Repayment terms vary significantly depending on the type of loan. For instance, short-term loans may have a repayment period as short as 90 days, whereas long-term loans can extend up to 10 years.

The repayment schedule could be daily, weekly, or monthly, typically determined by the business’s cash flow and the specific loan product. Some lenders offer unique repayment cycles, but these are granted on an as-needed basis to qualified borrowers.

What’s the Difference Between Contractor Business Loans and Traditional Financing?

The term “traditional financing” refers to more generic loan options such as home mortgages, personal loans, and general business loans, whereas contractor business loans are specifically tailored to meet the unique needs of contractor businesses. These more specialized options are intricately tailored to meet the needs of contractors, like handling delayed payments from clients, financing specific equipment purchases, or covering operational costs during off-seasons. The loan structures, terms, and eligibility requirements are all designed to accommodate the cyclical nature of construction work.

The main differences lie in the eligibility criteria, application process, use of funds, and repayment terms.

Eligibility Criteria

Contractor Loans: These loans are typically more accessible to contractors who may not have perfect credit scores but have proven cash flows or strong receivables. Lenders often consider the unique aspects of the contractor’s business model when determining approval, including the predictability of future earnings based on signed contracts.

Traditional Financing: Traditional financing usually requires stronger credit scores and a longer history of profitability to reach approval. Lenders assess risk based on rigid criteria that might not take the seasonal or project-based nature of a contractor’s work into account.

Application Process

Contractor Loans: The process is often streamlined to accommodate the fast-paced nature of construction projects. Lenders who specialize in this industry are familiar with the challenges contractors face and may require less traditional forms of proof of profitability, such as upcoming project contracts instead of past income statements.

Traditional Financing: Applying for traditional financing typically involves a more comprehensive and time-consuming review process. This might include detailed scrutiny of financial statements, tax returns, and other documents that prove the business’s viability over the long term.

E-Commerce SEO Package Tier 3

Month 1

Domain Authority Booster

Boost Your Rankings: Higher Domain Authority (DA) means better search engine rankings.

Outshine Competitors: Use DA to gain an edge and dominate your niche.

Score Quality Backlinks: High DA attracts valuable backlinks, boosting your site’s authority.

Starter Backlink SEO Package

100 Citations & Press Release: Establish your business identity with 100 citations and a branded press release for visibility.

50 Branded Websites: Build 50 high-authority sites linking back to reinforce your online presence and NAP (if any) details.

✅ 20 Niche Edits on High DA Websites with Traffic

✅ 20 Guest Posts on High DA Websites with Traffic

✅ 350+ Branded Press Releases

✅ 60 Blogs per month

Use of Funds

Contractor Loans: These loans are specifically tailored to support project-specific requirements such as purchasing equipment, hiring labor, or procuring materials ahead of project payments. The use of funds is well-suited to the project-driven financial cycles of a contractor’s business.

Traditional Financing: Traditional loan funds can be applied to a wider range of projects, such as marketing, organizational infrastructure strengthening, and expansion. These loans are not designed to meet the immediate or short-term financing needs of specific

Repayment Terms

Contractor Loans: Repayment terms are often aligned with the contractor’s cash flow, which may not be consistent year-round. This could include seasonal repayment schedules or balloon payments that coincide with a project’s completion.

Traditional Financing: Repayment structures under traditional loans are usually rigid and include regular monthly payments regardless of the business’s seasonal variations. This can be challenging for contractors who have gaps in their cash flow.

How to Apply for a Contractor Business Loan with Preferred Lending Network

Fill out a quick 30-second survey to direct you best lending partner.

Apply Securely Within Minutes: Move through our streamlined application and securely upload your business documents. After submitting your application, a Business Finance Advisor will reach out shortly to learn more about you, your business, and your unique circumstances.

Review Your Offers: Your Business Finance Advisor will identify the lenders most likely to provide you with a competitive offer. You’ll work with our lending partners team to prepare your applications in a way that positions your business for the best possible offers, then you’ll compare your offers with expert advice and select the best one for your specific circumstances.

E-Commerce SEO Package Tier 3

Month 1

Domain Authority Booster

Boost Your Rankings: Higher Domain Authority (DA) means better search engine rankings.

Outshine Competitors: Use DA to gain an edge and dominate your niche.

Score Quality Backlinks: High DA attracts valuable backlinks, boosting your site’s authority.

Starter Backlink SEO Package

100 Citations & Press Release: Establish your business identity with 100 citations and a branded press release for visibility.

50 Branded Websites: Build 50 high-authority sites linking back to reinforce your online presence and NAP (if any) details.

✅ 20 Niche Edits on High DA Websites with Traffic

✅ 20 Guest Posts on High DA Websites with Traffic

✅ 350+ Branded Press Releases

✅ 60 Blogs per month

Lastly; Step 4:

Receive Your Money: With a contract finalized, you’ll receive your funds and be able to use them promptly.

The main differences lie in the eligibility criteria, application process, use of funds, and repayment terms.

Revenue-Based Financing

Leverage your business's cash flow to maximize your funding amount.

Small Call to Action Headline

Funding Amount

$100,000 to $10 Million

Loan Term

You can opt for longer or shorter terms, depending on your business needs & capability

Time to Fund

24 to 72 hours

How Do You Qualify for Term Loans?

1+ Year In Business

$500,000+ in Annual Revenue

No Credit Score Requirement

What Is Revenue-Based Financing?

Revenue-based financing isn’t your traditional loan. Instead, it’s a financing solution that allows your business to secure capital—quickly and easily—by leveraging your business’s future sales.

Revenue-based financing can yield funding amounts as high as $10 million, making them a great alternative to traditional business loans. Even better, they’re much more accessible than other types of financing. Whether you’re a startup, a young business, or a seasoned veteran of your industry, revenue-based financing can be an advantageous method of securing the funds you need to capitalize on opportunities and solve challenges.

This type of financing is ideal for when you need cash in the short term and don’t want to go through the hurdles of applying for more traditional loan solutions, like business term loans or SBA programs. Basically, they’re a fast and flexible financing solution to speed up your growth, all without fixed monthly payments.

Revenue-based financing is usually unsecured, so you won’t need to offer collateral to reach an approval. Not only that, but it has the added benefit of keeping your cash flow steady by making payments based on your daily credit card sales instead of a set schedule. In other words, you can adjust your payments to how well your business performs.

If your business is profitable, revenue-based financing can help you take your operation to the next level. You can use the funds for a wide range of business expenses, including operating costs, growth opportunities, and much more.

How Does Revenue-Based Financing Work?

Revenue-based financing provides a lump sum of cash in exchange for a percentage of your future sales. Instead of managing monthly payments, you’ll repay your financing through small, automatic deductions, from your business bank account. Payments are predictable, allowing for enhanced forecasting.

The amount you’re seeking to borrow will have to correlate with your business’s profitability. For example, you may not be able to secure $4 million if you only generate $750,000 in annual revenue.

Fortunately, this type of financing is fast, and you can use the funds for almost any business purpose.

What Are the Benefits of Revenue-Based Financing?

Revenue-based financing has many benefits, some of which are exclusive to this type of business financing. For one, entrepreneurs who leverage revenue-based financing have the ability to manage short-term cash flow issues. Instead of “treading water” until they can afford the expense, they’ll find a lender offering this type of financing to find solutions to their challenges in half the time.

Another benefit of revenue-based financing is the speed of the process. Unlike other loan products, you can secure the funds you need within 24 hours—sometimes even faster. They’re among the fastest financing solutions available to entrepreneurs, and they’re frequently leveraged by those who commonly deal with seasonal lulls or frequent cash flow disruptions.

Lastly, revenue-based financing offers increased flexibility. Less restrictive eligibility criteria allow a wider range of entrepreneurs to reach an approval, and repayment schedules are determined based on your specific circumstances. The speed of the process also contributes to the flexibility of this option, as you can secure funds quickly to help you manage sudden or unexpected expenses.

No Personal Guarantee

Get funding for your business, without tying up personal assets in the process.

Flexible Payment Terms

No set payments—repayment is based entirely on day-to-day sales.

No Real Estate Collateral Necessary

You won’t need to leverage any personal (or business) real estate as collateral.

How Can You Use Revenue-Based Financing?

Revenue-based financing often comes with less restrictive eligibility criteria. At our Lending Partners, you’ll need:

1+ year in business

$500,000 in annual sales

That’s right—there’s no credit score requirement when you secure revenue-based financing with National. Our team draws on extensive lender relationships to secure approvals that competitors can’t, giving you an undeniable edge as you look to grow and outpace your competition.

What Are the Benefits of Revenue-Based Financing?

There are no restrictions—use your capital to pursue any opportunity or overcome any challenge!

Business Growth

Buy new equipment or inventory, hire new staff, or prepare for seasonal changes.

Business Expenses

Get extra working capital to manage payroll, bridge gaps in cash flow, or pay bills.

Business Opportunities

Expand or open a second location, take on more clients, or capitalize on bulk order discounts.

With revenue-based financing, the sky’s the limit. You can use the funds to purchase new equipment, add additional team members, cover operating costs, and much more. Plus, with flexible repayment terms, you can see success on your schedule with frictionless access to essential capital.

Why Choose Preferred Lending Network for Revenue-Based Financing?

Better Terms. Faster Funding. Tailored Solutions.

At Preferred Lending Network, we work with a broad network of lenders to ensure you’re matched with the best financing option for your business. Our goal is to provide flexible solutions, whether your business is well-established or just getting started, with lenders that cater to your specific needs.

With us, you can access funding without strict requirements for revenue or business tenure. Our streamlined process saves you time, offering fast approvals and funding so you can focus on growing your business.

Preferred Lending Network. Your Partner for Growth.

SBA Loans

Borrow up to $5 million, use the funds for any businHead of business loan sectionsess purpose, and secure the most competitive terms on the market.

How Do You Need To Qualify?

2+ Year In Business

$500,000+ in Annual Revenue

685+ Credit Score

Ownership of a Profitable Business

What Is an SBA Loan?

A Small Business Administration-backed loan, or an SBA business loan, can help your business to get working capital to accomplish any goal, like expanding, purchasing/refurbishing equipment, taking on new real estate, or refinancing an existing mortgage or agreement, and more.

SBA loans are one of the most desirable and sought-after types of business loans. Many small business owners apply for SBA loans before exploring other similar options. Between lower interest rates and substantially longer repayment terms, SBA loans tend to give you the funding you need without disrupting your cash flow.

While you can get SBA financing through both financial institutions like traditional banks and online lenders, they aren’t taking all of the risk. These loans are guaranteed through the SBA, a branch of the government dedicated to fostering stronger small businesses.

Through most lenders, SBA loans come with one drawback: it can take forever (up to 8 months) to complete the process. Banks thoroughly review loan applications, business plans, personal credit score, and more before providing an answer. When you use an SBA loan to drive revenue in your business, it can significantly improve cash flow.

Preferred Lending Networks Lenders has eliminated this issue by streamlining the process to 45 days! Through our network of lending partners, we can speed up the funding process to complete it in nearly half the time while also simplifying the long and complex procedure to make SBA funding much easier for you. With guidance from your Business Financing Advisor, you can even get an SBA loan with a tax judgment.

What Do You Need to Qualify for an SBA Loan?

If you’re looking to use an SBA loan for any purpose other than acquiring an existing business, here are the standard requirements:

2+ years in business

$500,000+ in annual gross sales

685+ credit score

If you’re looking to use an SBA loan to purchase an existing business, the requirements are:

10% down payment

680+ credit score

Industry/managerial experience

No criminal history (or the ability to explain misdemeanors on your record)

No current federal debt

If purchasing a franchise, a paid franchise fee

E-Commerce SEO Package Tier 3

Month 1

Domain Authority Booster

Boost Your Rankings: Higher Domain Authority (DA) means better search engine rankings.

Outshine Competitors: Use DA to gain an edge and dominate your niche.

Score Quality Backlinks: High DA attracts valuable backlinks, boosting your site’s authority.

Starter Backlink SEO Package

100 Citations & Press Release: Establish your business identity with 100 citations and a branded press release for visibility.

50 Branded Websites: Build 50 high-authority sites linking back to reinforce your online presence and NAP (if any) details.

✅ 20 Niche Edits on High DA Websites with Traffic

✅ 20 Guest Posts on High DA Websites with Traffic

✅ 350+ Branded Press Releases

✅ 60 Blogs per month

Your business, or the business you’re looking to purchase, must also fall within the SBA’s overarching eligibility criteria. Outside of the traditional minimum credit score, time in business, and annual gross sales requirements, your business (or the one you’re looking to purchase) must:

Operate for profit

Do business within the U.S. (or propose to)

Have “reasonable” owner equity to invest

Have sought out alternative resources, like personal savings and assets, before seeking assistance through the SBA

It’s important to know if your business qualifies BEFORE sending an application. That way, you won’t wait months only to find out you were ten points off the minimum credit score requirement, and you can avoid wasting precious time you could have spent running your business.

What Are the Benefits of an SBA Loan?

SBA loans are some of the most coveted financing options available to entrepreneurs because of their high borrowing limits and low-interest rates. SBA-sponsored lenders offer their financing products based on strict eligibility requirements, including high credit scores, extended time in business, and substantial annual revenue. If your organization doesn’t meet these criteria, you might find it difficult to qualify for some of the more substantial SBA financing programs, but you might be able to reach approval with a more lenient option, like SBA microloans.

Longer Terms

Build your business the right way, with term lengths ranging from 10-25 years

Prime Rate+

Access the best SBA rates and terms available through one simple application.

Express Funding

Get streamlined funding on loan amounts of $350K or less.

What Are the Benefits of an SBA Loan?

SBA loans are some of the most coveted financing options available to entrepreneurs because of their high borrowing limits and low-interest rates. SBA-sponsored lenders offer their financing products based on strict eligibility requirements, including high credit scores, extended time in business, and substantial annual revenue. If your organization doesn’t meet these criteria, you might find it difficult to qualify for some of the more substantial SBA financing programs, but you might be able to reach approval with a more lenient option, like SBA microloans.

Longer Terms

Build your business the right way, with term lengths ranging from 10-25 years

Prime Rate+

Access the best SBA rates and terms available through one simple application.

Express Funding

Get streamlined funding on loan amounts of $350K or less.

How to Apply for SBA Loans

The SBA loan application process is similar to applying for other forms of financing, with a few caveats. Here’s what to expect:

Determine Your Eligibility

Anyone looking to apply for SBA loans should first confirm that they meet the minimum qualifications. If you don’t qualify, you should seek out other types of lenders, including banks, credit unions, and non-bank lenders.

Choose the SBA Loan That’s Right for You

Next, you’ll need to decide which type of SBA loan will work best for your business and find SBA lenders. Consider the funding amounts, repayment schedule, and the finer details of each option to help you reach a decision. Once you’ve determined the one that aligns with your business goals, you’ll start your search for an SBA lender.

Find an SBA Sponsored Lender

Banking institutions, including Wells Fargo and Chase Bank, and some non-bank lenders, offer SBA loans. Their availability varies by state, so make sure to do some proactive research to ensure you have viable options in your area. If you’re having trouble finding a lender or you’d rather skip this step, consider working with a marketplace, like our lending partners, to simplify your search for lenders.

E-Commerce SEO Package Tier 3

Month 1

Domain Authority Booster

Boost Your Rankings: Higher Domain Authority (DA) means better search engine rankings.

Outshine Competitors: Use DA to gain an edge and dominate your niche.

Score Quality Backlinks: High DA attracts valuable backlinks, boosting your site’s authority.

Starter Backlink SEO Package

100 Citations & Press Release: Establish your business identity with 100 citations and a branded press release for visibility.

50 Branded Websites: Build 50 high-authority sites linking back to reinforce your online presence and NAP (if any) details.

✅ 20 Niche Edits on High DA Websites with Traffic

✅ 20 Guest Posts on High DA Websites with Traffic

✅ 350+ Branded Press Releases

✅ 60 Blogs per month

A Word From One Our Lending Partners on how speed up the SBA loan Process:

Submit Your Application

Finally, you’ll fill out your SBA loan application and send the required documents, including SBA-specific forms, three years of business/personal tax returns, business bank statements, licenses, certificates, and any other relevant documentation. Make sure to double-check that you have everything before sending!

Keep in mind – the SBA underwriting process takes anywhere from 30 days to 6 months, potentially longer if there are hiccups or there’s an error on your application, and you have to resubmit it.

There are no “best” SBA loans for every business. Each one will have different needs and unique circumstances, so it’s recommended to carefully consider the option you choose to ensure you’re able to take full advantage of your financing.

How Can You Use Your SBA Loan?

An SBA loan is an excellent way to finance your big business dreams. Whether you’re looking to start a business, expand one, or fund a special project, SBA loans offer the resources to do so, with generous terms that allow you to repay on an easy schedule. SBA loans also provide access to other resources, such as grants and tax incentives, so you can maximize the efficiency of your capital.

With SBA loans, you can make any idea a reality – from launching your dream startup to creating the perfect product or service.

Business Growth

Buy new equipment or inventory, hire new staff, or prepare for seasonal changes.

Business Expenses

Get extra working capital to manage payroll, bridge gaps in cash flow, or pay bills.

Business Opportunities

Expand or open a second location, take on more clients, or capitalize on bulk order discounts.

Small Business Administration loans can be used for “most” business purposes, including working capital, equipment, construction of buildings, purchasing land, and much more. You can’t use one for investment real estate (to sell or lease), refinance existing debt that would “expose the SBA to a loss,” pay delinquent taxes, or to relocate the borrower from a community where their departure would result in a significant increase in unemployment.

There are some usage distinctions between the loan types, too. According to the SBA, 504 loans can only be used for “major fixed assets that promote business growth and job creation,” meaning you won’t be able to leverage this type for working capital, inventory, or consolidating existing debt.

Remember – the “best” SBA loans are the ones that fit your business and where it’s headed. Make sure to carefully review the usage restrictions, terms, and interest rates before signing on the dotted line to ensure you can Grow to Greatness with as little friction as possible.

Meet Our Primary Investors

National Business Capital helps business owners find and secure competitive financing options to drive growth. With exclusive lender relationships and fast funding, NBC offers personalized support through business advisors to maximize investment returns. They have secured over $2 billion in financing, completing more than 27,000 transactions, and specialize in loans ranging from $100K to $5M+. NBC also supports community initiatives, delivering meals to those in need and participating in charity events. Their mission is to empower entrepreneurs with the capital and confidence needed to grow their businesses.

ARF Financial specializes in providing business loans and lines of credit for restaurants, hospitality, and retail businesses that may struggle to secure traditional funding. With over two decades of experience and partnerships with community banks nationwide, ARF offers fast, flexible loans with fixed terms up to 36 months. They have secured over $1 billion in financing and offer loan amounts of up to $1 million. ARF is committed to personalized service, local financial consultants, and transparent terms, helping businesses maximize their return on investment without disrupting cash flow.

Preferred Funding Group (PFG) is dedicated to helping businesses secure the funding they need, whether they are a startup with no revenue or an established business seeking to grow. Offering unsecured funding options ranging from $50,000 to $500,000+, PFG provides a seamless funding experience with no collateral requirements or minimum business length. PFG takes pride in delivering white-glove customer service, competitive rates, and tailored solutions for each client’s unique needs. Their team of funding specialists, with over 35 years of combined experience, ensures transparency, integrity, and exceptional service throughout the funding process.

10 Reasons Why Preferred Lending Network Offers the Best Small Business Financing

Business Empowerment Solutions

Unlock Your Business Potential

© 2025 All Rights Reserved